Pacific Prime Can Be Fun For Anyone

Your representative is an insurance policy professional with the expertise to lead you through the insurance coverage process and aid you locate the very best insurance policy protection for you and individuals and things you respect many. This short article is for informative and pointer functions only. If the plan coverage summaries in this article conflict with the language in the policy, the language in the policy applies.

Policyholder's fatalities can additionally be backups, specifically when they are considered to be a wrongful fatality, as well as building damage and/or devastation. Because of the uncertainty of claimed losses, they are identified as backups. The guaranteed person or life pays a premium in order to get the advantages guaranteed by the insurance company.

Your home insurance can aid you cover the problems to your home and manage the price of restoring or repairs. In some cases, you can also have insurance coverage for things or valuables in your residence, which you can then purchase substitutes for with the cash the insurance policy business offers you. In case of a regrettable or wrongful fatality of a single income earner, a household's monetary loss can potentially be covered by particular insurance coverage strategies.

The Definitive Guide for Pacific Prime

There are various insurance prepares that consist of savings and/or investment systems along with normal insurance coverage. These can assist with structure financial savings and wealth for future generations using routine or reoccuring financial investments. Insurance coverage can aid your household keep their requirement of living in the occasion that you are not there in the future.

One of the most basic kind for this sort of insurance coverage, life insurance, is term insurance coverage. Life insurance policy as a whole assists your family become safe and secure financially with a payout amount that is given up the occasion of your, or the policy holder's, fatality during a certain policy period. Child Strategies This kind of insurance policy is generally a savings instrument that assists with creating funds when kids reach specific ages for going after greater education.

Home Insurance policy This sort of insurance covers home problems in the incidents of accidents, natural tragedies, and accidents, along with other comparable occasions. international health insurance. If you are wanting to look for settlement for mishaps that have occurred and you are battling to identify the correct More Help path for you, get to out to us at Duffy & Duffy Law Practice

10 Easy Facts About Pacific Prime Shown

At our law practice, we understand that you are going with a great deal, and we recognize that if you are pertaining to us that you have actually been with a whole lot. https://www.pubpub.org/user/freddy-smith-2. Due to that, we provide you a cost-free consultation to review your problems and see just how we can best help you

Since of the COVID pandemic, court systems have been shut, which negatively affects car accident instances in a tremendous method. Again, we are below to help you! We happily serve the people of Suffolk County and Nassau County.

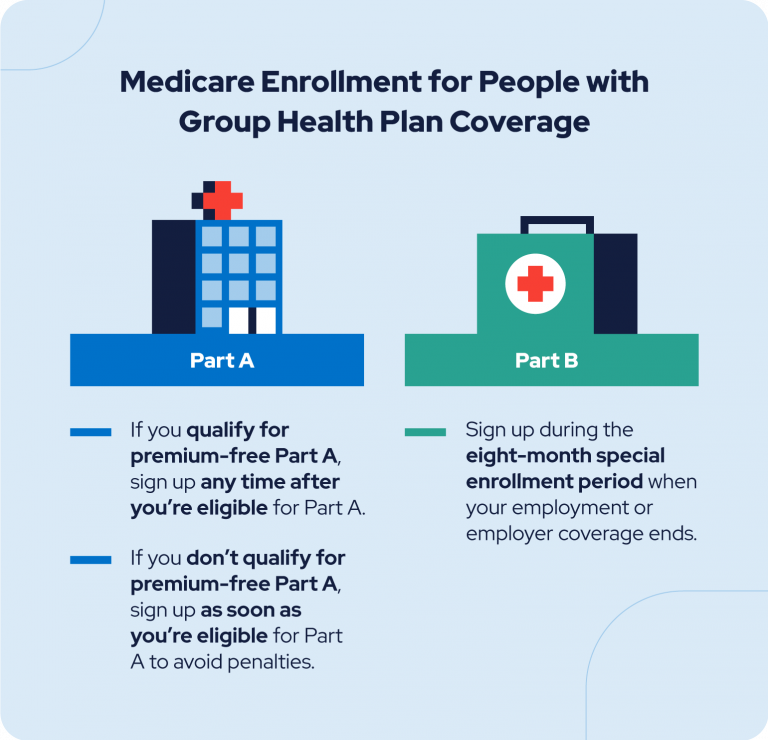

An insurance plan is a lawful contract in between the insurer (the insurer) and the person(s), company, or entity being insured (the insured). Reviewing your plan aids you validate that the plan fulfills your demands and that you comprehend your and the insurer's obligations if a loss happens. Numerous insureds buy a policy without comprehending what is covered, the exclusions that take away protection, and the problems that have to be satisfied in order for coverage to use when a loss takes place.

It identifies that is the insured, what risks or property are covered, the plan limits, and the policy duration (i.e. time the policy is in pressure). The Statements Page of an auto policy will include the summary of the lorry covered (e.g. make/model, VIN number), the name of the individual covered, the costs quantity, and the deductible (the amount you will have to pay for a case before an insurance firm pays its part of a covered insurance claim). The Statements Page of a life insurance plan will include the name of the individual insured and the face quantity of the life insurance policy (e.g.

This is a summary of the major promises of the insurance provider and mentions what is covered. In the Insuring Agreement, the insurance company concurs to do particular things such as paying losses for protected perils, giving specific services, or accepting defend the insured in a liability suit. There are two basic kinds of a guaranteeing agreement: Namedperils coverage, under which just those risks especially provided in the plan are covered.

The 25-Second Trick For Pacific Prime

Allrisk coverage, under which all losses are covered except those losses specifically omitted. If the loss is not left out, after that it is covered. Life insurance coverage plans are typically all-risk policies. Exemptions take insurance coverage away from the Insuring Arrangement. The 3 significant types of Exemptions are: Omitted dangers or root causes of lossExcluded lossesExcluded propertyTypical instances of excluded dangers under a home owners policy are.